Trade competitiveness in SEMED

Thierry Senechal, CEO of consultancy firm Finance for Impact, gives an overview of trade performance in the southern and eastern Mediterranean (SEMED) region

Jordan

Jordan has been hit by a regional crisis of unprecedented magnitude, which has negatively affected the capacity of firms to conduct crossborder trade. Jordan’s exports and imports have declined recently, with the trade deficit reaching US$ 11.5 billion in 2016.

Still, the business environment remains resilient, mostly because Jordan has successfully launched business reforms. For instance, it has improved its credit information system, established a private credit bureau, modernised its customs administration and introduced efficient cross-border trade processes.

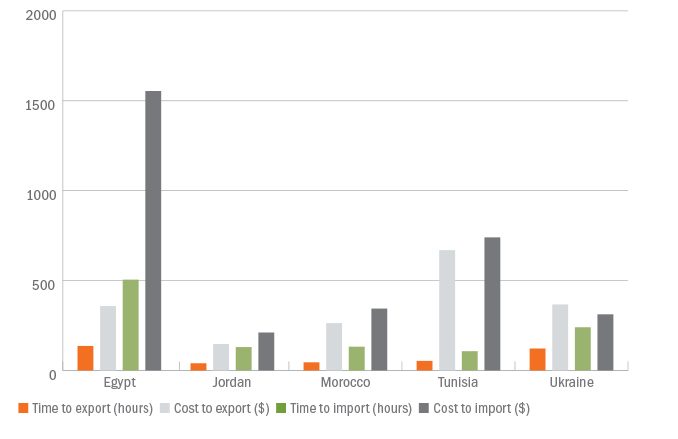

As a result, Jordan has managed to maintain GDP growth above 2 per cent in the past three years. Time and cost to import and export in Jordan remain far below the SEMED average. For example, in 2016 it took three documents to complete normal export processing and six documents for a normal import processing. Jordan’s ranking in The World Bank Logistics Performance Index also improved from 102th position in 2012 to 67th in 2016, putting it in the category of a “logistically friendly country”.

Historically, Jordan has been considered a natural hub for transit trade in the region. However, transit trade between Jordan and neighbouring countries is now more difficult because of border closures. Anecdotal evidence suggests that about 5,000 trucks used to make the Jordan-Syria cross-border trip each month before the Syrian uprising; that number has now plummeted to 100.

To service the trade community, Jordan offers a diversified and well-performing banking system that includes 25 banks (16 Jordanian and 9 foreign). The total number of branches is 18.3 per 100,000 adults, which is in line with the average for the region. The bank’s total assets-to-GDP ratio (169.7 per cent) is the fourth highest among selected Arab countries after Qatar (516.9 per cent), Lebanon (340.1 per cent) and United Arab Emirates (198.7 per cent).

While lending has increased over time, the focus remains too much on households. The credit facilities extended to small and medium-sized enterprises (SMEs) only reached 8.7 per cent in 2016 (of all credit facilities), whereas the SEMED region’s average is around 20.0 per cent. The percentage of firms accessing the banking system to finance working capital is 26.1 per cent, below the figure for Morocco (49.3 per cent) or Tunisia (44.7 per cent). Jordan’s total trade finance portfolio was estimated at about US$ 8 billion in 2016, or about 25-30 per cent of the total volume of cross-border trade for the same year.

About 60 per cent of trade finance is provided by three commercial banks, with each of them having a trade finance portfolio of more than US$ 1 billion. “Plain vanilla” trade finance is available in most banks, for example letters of credit (L/Cs), guarantees, standby letters of credit and bills of collection, but modern supply chain finance solutions are not (or are rarely) part of the offering.

Tunisia

Tunisia’s economy has for the last few years been evolving against a backdrop of protracted political transition and a difficult international economic environment. GDP growth has remained modest (0.8 per cent in 2015 and 1.3 per cent in 2016) due to slower activity in the manufacturing, tourism and mining sectors. Unemployment remains high for women (22 per cent), young graduates (30 per cent) and youth (35 per cent).

In terms of trade performance, buoyant imports – especially for energy, capital goods and raw materials for the textiles and auto sectors – along with declining exports for some agricultural products widened the current account deficit.

Transit trade with neighbouring countries also declined. Exports to Libya, of mostly agricultural products, construction material, steel and consumer goods, significantly dropped since 2011; imports, consisting mostly of oil and related products, have almost halted.

The Tunisian banking sector is quite dense and comprises a large number of commercial banks and other financial institutions. Currently there are 23 banks (three public), one offshore bank, two investment banks, eight leasing firms and two factoring firms for 11 million inhabitants.

In past years, the banking sector has shown mixed financial results, suffering from the combination of post-revolution instability, Europe’s anaemic growth and sustained security risks. The level of non-performing loans (NPLs) remains a challenge; NPLs comprised about 17 per cent of total loans at the end of 2016 and many banks still keep on their books a significant number of loans from the troubled tourism industry.

There is also a continuing bank liquidity problem, with most financial institutions relying on central bank funding as credit growth remains higher than deposit growth. As evidence of these liquidity constraints, there is a persistently low deposit-to-GDP ratio (58.6 per cent in 2015), far below the ratios in Morocco and Jordan. Furthermore, customer deposits are insufficient to fund the system’s loan portfolio growth.

Tunisia’s total trade finance portfolio was estimated at about US$ 7 billion in 2016. Most commercial banks offer trade finance tools, and of these the import L/C is the most widely used to facilitate the import of large volumes of goods. Of the total trade finance portfolio, the import L/C represents 34.7 per cent (against 9.5 per cent for the export L/C). International guarantees (inward and outward) are also typically used in cross-border transactions, as well as collections.

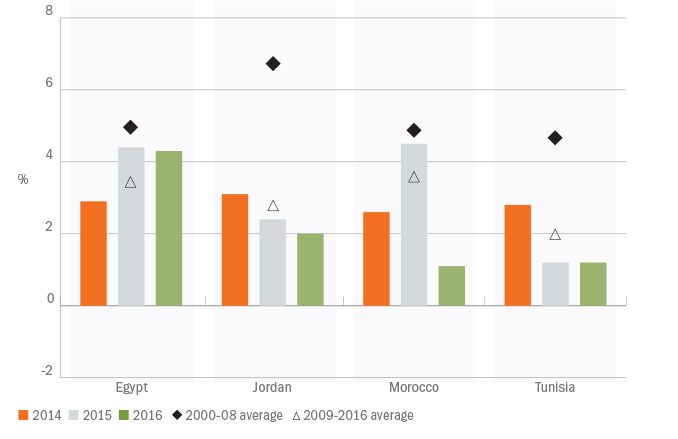

GDP growth in the region

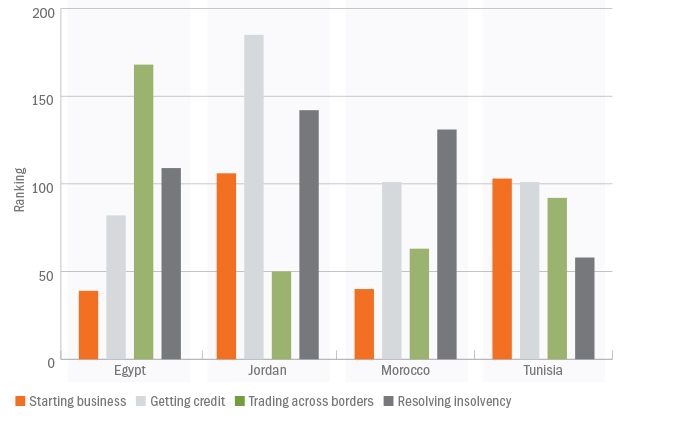

Trade performance in the SEMED region

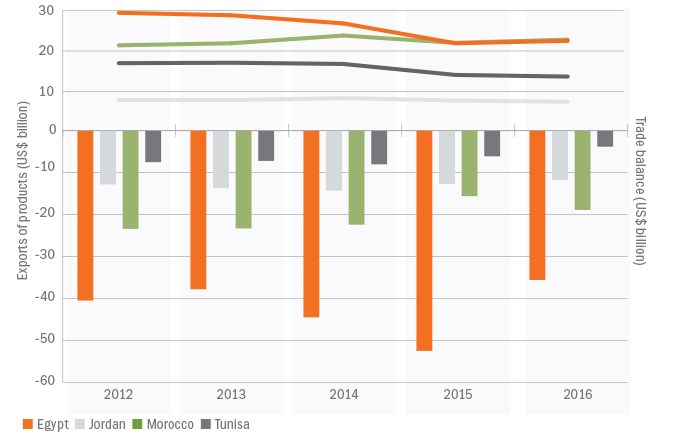

Exports and trade balances 2012-16

Time and costs of cross-border trade, 2016

Morocco

The Moroccan economy depends heavily on weather conditions. After a record cereal production in 2015, Morocco suffered a severe drought in 2016. As a result, agriculture production (representing almost 15 per cent of Morocco’s GDP), contracted by around 10 per cent and dragged the overall GDP growth down to 1.1 per cent in 2016.

Exports remained stable, reaching US$ 22.8 billion in 2016 (against US$ 22 billion in 2015), but imports moved from US$ 37.6 billion in 2015 to US$ 41.7 billion, thus increasing the trade balance deficit.

Although Morocco has reduced barriers to trade by liberalising controls in the last 10 years, there is still a substantial level of protection, excessive formal protocols and bureaucracy leading to long wait times for cross-border trade.

According to the World Bank’s Doing Business surveys, Morocco’s ranking for trading across borders significantly deteriorated between 2014 and 2016, moving from 31st to 63rd (out of 190 economies). The enforcing of contracts and the resolution of insolvency remain two major impediments to trade development in Morocco.

According to the World Bank’s Doing Business 2017 report, it takes 510 days on average to enforce a contract in the case of a dispute at the cost of 25.2 per cent of the claim. Insolvency proceedings involving domestic legal entities are lengthy and costly; on average, it takes 3.5 years to resolve insolvency, with the recovery rate being 28.1 cents to the dollar.

The World Bank Logistics Performance Index also showed Morocco’s ranking dropping from 50th in 2012 to 86th in 2016 (out of 160 countries), putting it in the category of “partial performance of logistics providers”.

Morocco’s financial system is bank-dominated and highly concentrated. There are 83 financial institutions, including 19 universal banks with total assets of about 140 per cent of GDP. The top three banks – Banque Centrale Populaire (BCP), BMCE Bank and Attijariwafa – account for over two-thirds of banking assets and deposits.

The banking system is characterised by its openness to international markets, which is reflected both by the presence of foreign institutions in Morocco and Moroccan banks abroad.

Morocco’s institutions include some of Africa’s largest banks, and several have become major players on the continent and continue to expand their footprint. For instance, BCP and Attijariwafa cover 11 and 10 countries in Africa, respectively. BMCE Bank has become the second largest banking group in Africa, with a presence in 20 countries.

Moroccan banks are adequately capitalised and profitable, mainly due to large interest rate margins, low operating costs, and rising fees and commissions. There is no overall capacity constraint. Short-term liquidity is said to be abundant in the largest trade finance banks, in line with the favourable risk profile of the industry.

The usual range of traditional trade finance products and services is available to corporates to support their crossborder transactions, including L/Cs, bank guarantees, standby L/Cs, performance bonds, short-term import and export loans, open account and supply chain finance services.

Egypt

The government has been implementing a bold and transformational reform programme aimed at boosting the economy and enhancing the country’s business environment. Despite the government’s current efforts, social conditions remain a concern; inflation caused by the currency flotation, energy subsidy reform and other food price shocks have significantly affected Egyptian households, especially the poor and the vulnerable segments of the population.

Unemployment continues to be high at 12.7 per cent in 2016, and rates are higher among the youth and women.

The sharp increases in inflation (10.2 per cent and higher for food) have negative short-term effects.

As the SEMED country with the highest GDP (US$ 332.3 billion), Egypt’s cross-border trade is comparatively low (in 2016, exports and imports reached US$ 24.6 billion and US$58.7, respectively). The European Union remains a strong partner and bilateral trade with the EU more than doubled between 2004 and 2016, reaching its highest level in 2016 (from €11.8 billion in 2004 to €27.3 billion in 2016).

But there are significant barriers to trade in Egypt. According to the World Bank’s Doing Business surveys, Egypt’s ranking for trading across borders significantly deteriorated between 2014 and 2016, dropping from 99th (out of 190 economies) to 168th. There are many reasons for this drop, such as the lengthy time needed for, and high costs of, importing goods and services – 505 hours and US$ 1,554 for a standard transaction in 2016, respectively, against an average of 123 hours and US$ 432 for a similar transaction in the three other SEMED countries.

There are 38 banks registered in Egypt. The National Bank of Egypt, Banque Misr and Banque Du Caire, the three largest public banks, control 40 per cent of the banking sector. Bank assets increased by 27.4 per cent between October 2015 and October 2016.

The corporate sector accounted for 57.9 per cent of total credit facilities, while household deposits acquired 61.78 per cent of total deposits at the end of October 2016.

Return on average assets and equities posted 1.5 per cent and 24.4 per cent, respectively, and a net interest margin of 4.0 per cent for 2015. The ratio of NPLs to total loans reached 5.9 per cent at the end of June 2016, which is far below the average in other SEMED countries.

Conclusion

The trade markets in the SEMED region labour under several constraints, including the use of systematic collateral, which prevents SMEs from accessing short-term trade finance, and the decline in the number of correspondent banking relationships, which could have negative consequences for trade performance. However, unrealised (postponed) foreign trade demand is expected to be satisfied in the future when current macroeconomic constraints are removed.

The banking system is characterised by its openness to international markets, which is reflected both by the presence of foreign institutions in Morocco and Moroccan banks abroad.